The people creating the tutorials and videos simply never check them against each other after Panda's crunches the numbers. I've read, watched and followed tutorials on the subject, but their results also don't match the accepted/published EMA's you'd find on any finance site. It's even wrong when I just try for 5-Day EMAs. And I get the wrong numbers no matter what date I try to compute the EMA for. when the real 20-Day EMA on any finance site is $45.65. df2.shift().fillna(df).ewm(com=1, adjust=False).mean() df2.ewm(span=20,min_periods=0,adjust=False,ignore_na=False).mean()

They match each other, but not me.įor example. Trend Indicator - Based on 4h 50/200 ma/ema - Static, same accross all timeframes - Works best with trending assets. When I look to the bigger stock websites like MarketWatch or Fidelity, their numbers don't match mine. It contains the daily Date, Month Name, Open, High, Low, Close, Day Avg, and Volume for Intel's stock (Ticker: INTC) from to.

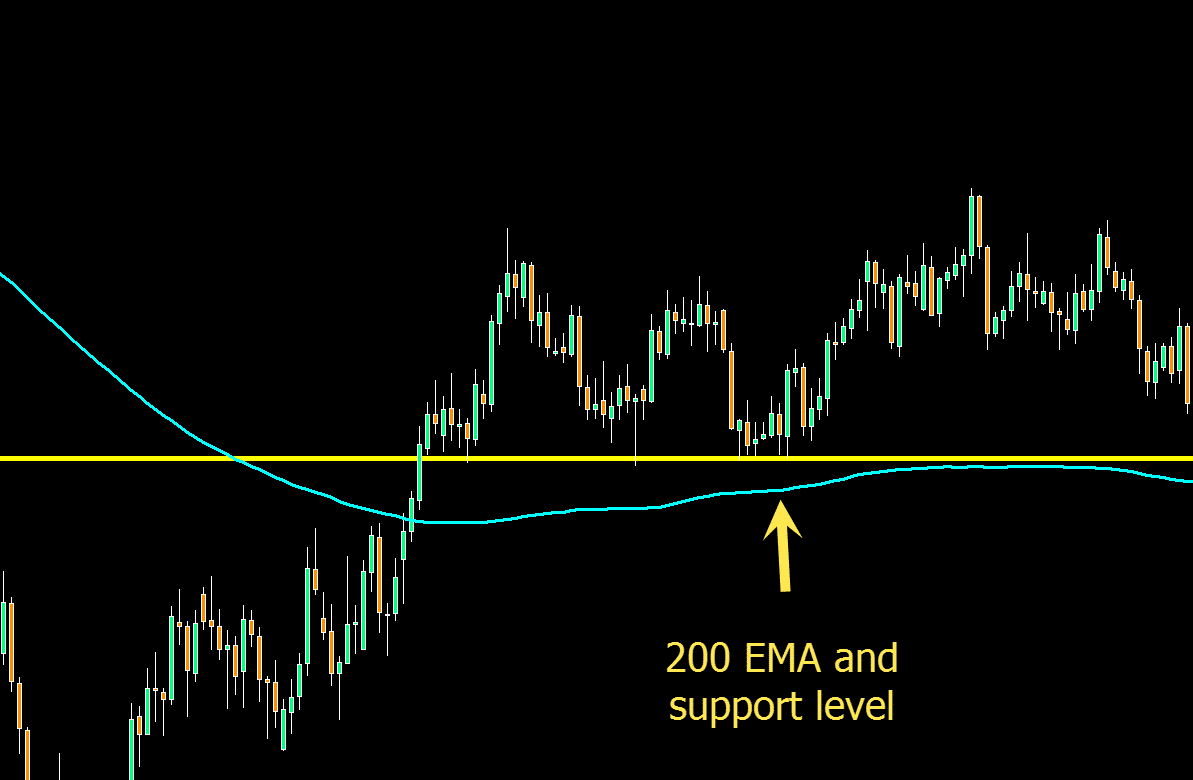

This is the CSV I'm using: INTC Stock Data This is a bearish scan which indicates that the 100 days EMA is crossing. I've double checked the close prices, and they match, but the EMA always comes out "wrong". In StockEdge you will get the technical chart with EMA plotted by clicking on the name of stock as shown below: Example 2: 100 EMA Crossing 200 EMA from Above: A trader can also get buy and sell signals from the crossovers of the smaller period EMA and longer period EMA. Pandas has a number of ways of doing this, and I've also tried stockstats, which runs on Pandas, but they never return the same EMA as I get from stock/finance websites. I am trying to use Python (with Pandas) to calculate the 20-day Exponential Moving Averages (EMA) of daily stock data for Intel (INTC).

0 kommentar(er)

0 kommentar(er)